M&Ms: Electronic Herds

The Internet is now full of Electronic Herds in the 97th edition.

The Electronic Herd stampedes at the speed of light.

Over 40 billion dollars were withdrawn from Silicon Valley Bank on Thursday. And by Friday, the Bank was insolvent. What happened to Silicon Valley Bank this week is the fastest bank run in history.

In the Black Swan, Nicholas Taleb said:

"Ever since we left the Pleistocene, some ten millennia ago, the effect of Black Swans has been increasing. It started accelerating during the industrial revolution, as the world started getting more complicated."

If Black Swans increased during the industrial revolution, they've skyrocketed recently in the modern interconnected Internet era.

That's because the modern era has given rise to Electronic Herds that can cause crazy things to happen before anyone can react.

In 2007, before the collapse, Warren Buffet warned to be careful of the first "Electronic Herd."

Wall Street called him a fool.

Then, before the end of the year, everything collapsed.

We've learned a lot about Electronic Herds since Buffet warned about them.

First, unlike in 2007, when a few people had their fingers on buttons that could move money, we are all a part of some electronic herd now. It is impossible to avoid. In fact, as we see with SVB, avoid the Herd at your own risk. And there are tons of these Electronic Herds all over the Internet now. And they won't be going away anytime soon. So we might as well make an attempt to understand them.

Secondly, a stampede from an Electronic Herd could be good or bad, depending on where you stand at the time. In the same way that the Black Swan that is the Internet turned out to be a net positive for society. Sometimes, shakeups can be good.

Take the GameStop Saga during January 2021. With everyone still locked down by the Covid pandemic, the now famous Wall Street Bets subreddit called on its members to buy GameStop stock and squeeze out the massive short positions on the company.

I am ashamed to admit that I partook in that Electronic Herd.

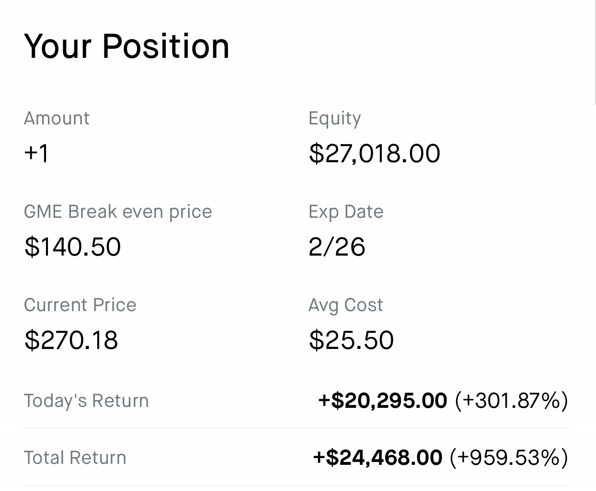

I bought one option position when the call went out. Of course, I knew I might lose all the money I put in that position. But it was a small bet for me at the time. And it felt like a good cause. It was to fight back against the hedge funds that were unfairly squeezing poor little GameStop out of business.

I would learn firsthand in 2021 that there is real power in these small and niche communities on the Internet. At the time, Wall Street Bets was a tiny community, but there would be millions before the saga was over.

That week, my one-option position in GameStop made me $30k+ in less than 48 hours.

I was in shock; this was no longer a small bet for me. I didn't go in expecting that sort of return. In fact, I fully expected to lose everything. But with that kind of return, I decided that my family could surely use that money.

So, I sold out.

Luckily, even without me, the GameStop stock whipsawed up and down. Electronic Herds are hard to stop.

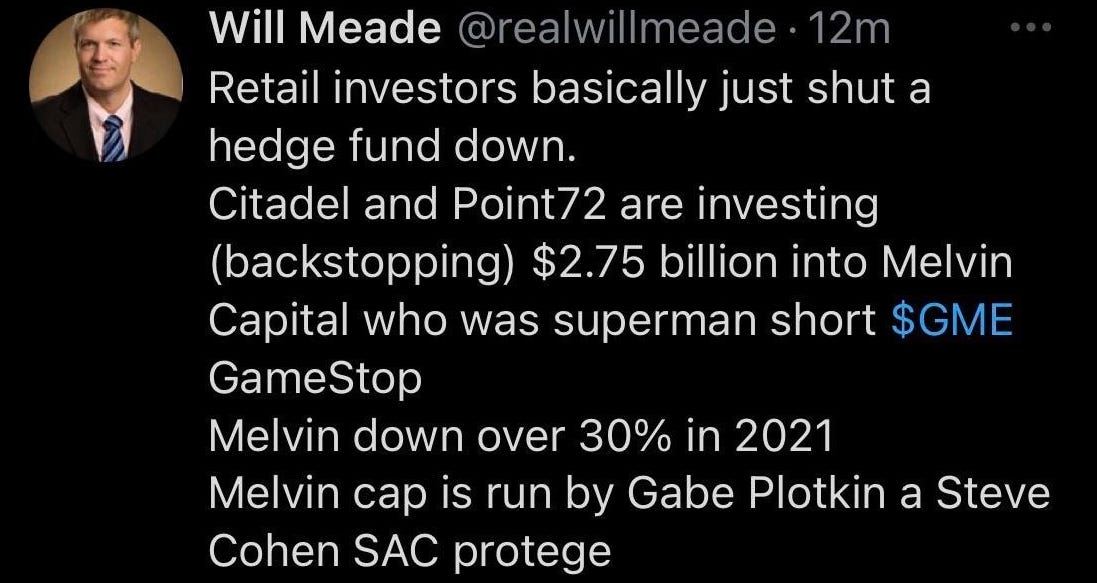

And in less than a week, it put the hedge fund Melvin Capital out of business. And put lots of scrutiny on what these hedge funds were doing. It put many others in Congress's crosshairs, including Citadel Investments.

And it was shocking to see to what length these institutions were willing to go to protect the rich and powerful.

But good or bad, the lesson is that if you are the unfortunate institution standing in the way of an Electronic Herd that is about to stampede like Silicon Valley Bank was this week, you will likely not make it.

Today the government announced that it would make sure all depositors of SVB are made whole. In my opinion, this is a good thing, especially given many of those depositors are smaller early-stage startups that have employees to pay. And it is a good thing because it might help reduce Electronic Herds from stampeding other banks. But, unfortunately, the stockholders of SVB and its executive team have all been stampeded over.

And this phenomenon of Electronic Herds causing Black Swan events is not likely to slow down.

Much like the famous running of the bulls in Spain, you have three options in dealing with Electronic Herds in the modern era:

Stand on the sidelines and don't participate in the Internet.

Find an Electronic Herd to run with.

Or get trampled.

Three Tweets: You Don’t Know Sheep, Change in Feelings, Many Shots

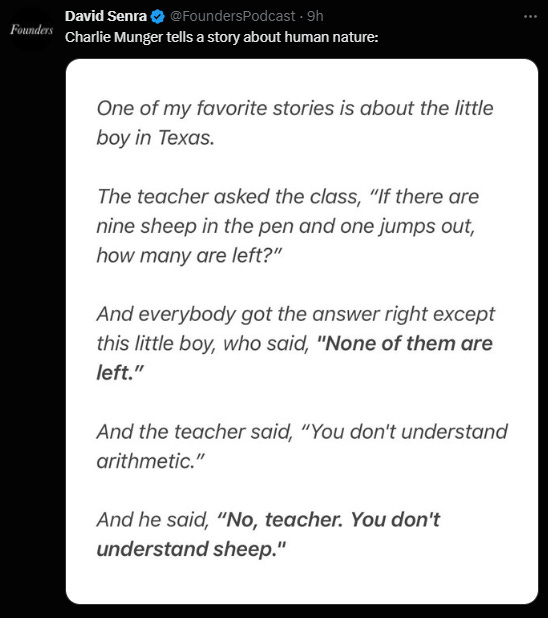

This story by Charlie Munger highlights the power of herds.

We, humans, tend to frown upon herd behavior. And tend to think of herds as only bad things, but there are sound evolutionary reasons why animals behave this way.

Sometimes going in a different direction than the Herd can lead to the animal's demise.

The SVB situation exposed something important.

There is a huge change going on in how people feel about Venture Capital and Venture-backed startups. This change of feelings started with people turning on Big Tech, and it has now moved to Startups, VCs, and Venture-backed founders. It feels like a group that used to be lionized is no longer viewed as positively.

A shocking amount of people were against any help for depositors above the $250k FDIC insurance. And of course, Twitter is not real life, but still, it was shocking to read many of the comments.

This is an important observation; I think if you want to study Electronic Herds.

In this one Tweet, James Clear perfectly captures why I am such a big fan of placing Small Bets in the internet era.

Three Memes: Cable, Mazda or Ferrari, The Movement

In the end we might just get cable again.

One relevant meme from the GameStop era.

As always, thank you for reading.

-Louie

P.S. you can reply to this email; it will get to me, and I will read it.

I find this fascinating and scary.

That week, my one-option position in GameStop made me $30k+ in less than 48 hours.

I was secretly looking for thee kinda bet.. to be Frank I burnt all my small bet😀..

Other than that it’s a honest write up.... most online influencers talk but never revel what’s truly done.. good to know about your short bet.. scary.. also what do you mean by

Find an Electronic Herd to run with.

Look out for small bet 👀.??(im actually)😂