M&Ms: The Tech Startup Dogma

I made a huge mistake believing the dogma that people with tech skills, like me, should only start a venture-backed startup.

Charlie Munger said, "I like people admitting they were complete stupid horses' asses. I know I'll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn." So, to make it right, I, too, will be rubbing my nose in my mistake in this essay.

So, let's start from the beginning.

I've always dreamed of becoming an entrepreneur. But I was always afraid of taking the risk because I had a good thing going with my high salary. I was born poor and as an immigrant, grew up poor in The Bronx, NYC. I always felt the risk was higher for someone like me because we don't know much about building businesses where I come from, and I now had something to lose: my salary.

I desperately grasped for straws to try and learn from those who "knew." I read books and watched YouTube Videos. I took YC's free StartUp School program, among many others. Add to this that I was a software engineer with lots of experience managing other engineers. And I'd worked at startups and big companies alike. Everyone told me my odds were good.

I was inundated deep into the dogma, like most software engineers are. Everyone in tech is bombarded with heroic stories of tech founders who made it big. Ironically, most of the ones to admire did it before the last decade. But in the last decade, the venture-backed path seemed like the only path for anyone serious. It all seemed so simple: make something people want, get the money from VCs, and fulfill your dreams.

But is it really that simple?

Since I struggled to raise the venture dollars on my own, but I knew I could build almost anything, I partnered with salespeople. And we raised venture dollars. And this is where things go south for me.

But first, can I say what a ridiculous dream that seems to be?

Many are struggling. Like my family was before I got into tech, and here I am, dreaming of founding something and getting to the millions.

But I have a friend who used to tell me, "If I can get to a few million, then my entire immediate family will be okay. But if I can get to a hundred million, I can change my entire town. And if I can get to the billions, I might be able to change the old country." That's the sort of dreaming and ambition America encourages, and so maybe that dream itself is not so ridiculous.

And if you don't think one person in business can change things, you haven't been to Bentonville, Arkansas. The Walton’s now live in the nicest city in the Midwest; I know because I worked at Walmart and frequented Bentonville, their HQ, to touch base with the mothership after they acquired the high-tech startup I was a part of.

To illustrate how far business success can take things, the Crystal Bridges Museum is the nicest American Art museum in the world. That Museum even houses the original George Washington painting that is the basis of the dollar bill.

How crazy is it that the best American Art museum would not be somewhere on the wealthy coasts but in middle America? But that's what money does. And the Museum is kept free, too, by the Waltons for everyone to enjoy. Sam Walton got to the billions and subsequently that changed his town, his state, and probably the country.

So, I take back what I said. It's not ridiculous to have ambition and to dream. It's just that it is more challenging to pull off than how it's sold to us tech founders. And it is a dream that has been hijacked. They've hijacked it to make us believe early venture dollars are the only way to do it.

But Sam Walton did it right, built a real business not a pretend one to dump on the masses.

Think about the last decade and a half, with its low-interest rate and abundant dollars. Who did that help? I am paraphrasing Nicholas Nassim Taleb here in an interview he did with Bloomberg: It helped the rich get really rich and exacerbated wealth inequality. It encouraged businesses that can be dumped on the average investor. It encouraged crypto that would leave large groups holding the bag.

I believe Taleb is right. I believe most tech startups started in the last decade are deformed in some way, thanks to cheap interest rates and abundant dollars. Think Uber, think WeWork, and so many more. The startups I worked for are no exception. And yet, the founders believed in the dogma. And some achieved it. Every casino has to have some winners, or no one will show up. But the Casino owners make their money no matter what. VCs peppered the market with seed, and pre-seed investments funded most of them. And the few winners paid for the losers. This would be fine if the majority of those jobs were going to stay, but I don't think they will. And it would all be fine if regular retail investors weren't left holding the bag.

But contrast all that with Sam Walton's Walmart, which is still standing. He built it up store by store, small bet by small bet. (or contrast it with most tech companies before 2008) Sam raised money as he needed it and could put it to work. There isn't anything wrong with venture dollars that can be put to work to earn more dollars, but too much too early, and they encourage the last decade of “business.”

Sam didn't build Walmart because of some dogma he bought. He just layered win after win. By the way, Bentonville is still benefiting from Sam Walton's prudent risk-taking; people have amazing jobs there, its not just the museum, and so on.

But back to me, after quitting my job, I foolishly believed the dogma that you need investors with skin in the game early in your thing to succeed. At this point, the old me would ask you to cut me some slack. As an immigrant from poverty, I didn't know much about business. But in the end, it was my fault. As Charlie Munger said, it's time to rub my nose in it. I sought those venture dollars. I drank the cool-aid. I put on the shackles of a tiny salary, and I took on the many bosses. I ate the ramen. All for a chance at the dream.

What a fool I was.

I blame myself for believing all that. And the wasted personal resources early in that process, that's what I deserve.

But in a lot of ways, I am lucky. I stumbled into community of other people not trading everything away, including their freedom, to chase a pipe dream. I internalized fast that there is no one way to build a business and no one truly “knows.” So I am lucky, because the unfortunate thing is a lot of software engineers turned entrepreneurs do bang bang their heads against the wall for years, eating ramen, trading away all their freedom for a tiny tiny shot. When they have good odds to build things that make money and open new opportunities to layer on wins for themselves.

So, I changed my ways. Now, I am making money as an entrepreneur. And I set myself up to keep trying in business. And the lesson for me, as an engineer, was that an early venture-backed business is not the only way to be an entrepreneur.

A Small Promo from Me:

Daniel Vassallo and I have been layering on a lot of new things onto the Small Bets community. A few new things we’ll be launching very soon.

But one thing that worked well is the the guest classes from people with real hands on domain experience. So we booked a bunch more, with more to come:

And we are running a $60 dollars off the lifetime membership to Small Bets. You will get the old stuff with the lifetime membership and the new stuff we will launch soon.

Four Tweets: Health Care, Business, Climate

Unfortunately, the community note is right, health care is really expensive in America.

I was in fact paying $1872 a month for COBRA, family of 4, for the maximum duration allowed.

I did this so my family wouldn’t lose healthcare after I quit my job to chase entrepreneurship.

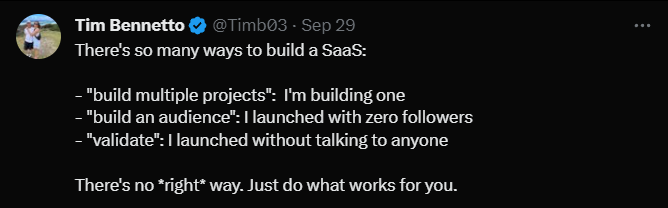

I believe this tweet is right, when it comes to business, there is no “right way.”

There are things we should do to increase our odds but we all have a journey to go on. And nobody can do it for you.

There is that dogma they want you to believe being pushed by Fast Company.

I’ve been a little quiet because we were underwater here in NY.

One of my rental properties is in a flood zone, so we were trying to avert disaster:

It was a scary one.

Two Memes: Parking, Commit.

All joking aside, ChatGPT is a great tool.

That is a screen shot of somebody’s Github commit history, for my non tech friends it’s greener the more code they commited.

Here is mine, Sept is looking like a good month.

—Louie

P.S. You can reply to this email; it will get to me, and I will read it.

Louie, excellent article as usual.

A small correction to the article (If I may suggest): Bentonville is not in the mid-west. Its in the South.

Nice spiky point of view, Louie! But I wouldn't go as far to say tech startups that grew big fast under ZIRP are deformed. Part of our entrepreneurial culture is to be pragmatic and make the most of whatever environment we're in. There are many paths to success and saying that ways other than small bets are deformed is a wee dogmatic too 😂