M&Ms 55: Hard Times

Hey Team,

I think the world is in bad shape.

I am usually a very optimistic person, but several bad things are going on at once, making me pessimistic in the short term.

We have two significant nations at war, and both are effectively cut off from the global GDP at least in the short term. One is practically destroyed, that's Ukraine, the other is a pariah, and no one will be able to trade with them or buy their gas soon, and that's Russia. Even if things don't escalate, this is bad enough, especially because both nations are critical to Europe's economy. One produces Europe's wheat and food, among other things; the other produces its fuel. And Europe is vital to the global economy.

Also everyone will have to prioritize security over global trade in the future. That means more nations will start making things themselves and less reliance on each other. We have seen U.S. and China relations strain, but now even more so, each taking a different side in the conflict.

All of this means less trade, and of course, less trade means less efficiency.

We already lost tons of efficiency by having two nations entirely out of the global GDP due to the war; couple all of that with rising inflation across the globe, and you can see bad things start to compound. Everyone printed money to help their people through the pandemic, and the picture now looks even grimmer.

Of course, I am not the first to notice this; the markets were first.

Tech took a huge tumble earlier in the year, then crypto this week.

Yes, most tech companies are still making money. Yes, some have solid fundamentals, but what happens when people can't afford food and gas? Will they spend their hard-earned dollars on things they don't need? Will advertisers have money to spend when the returns aren't there? Will anyone have the appetite to prop up digital gold (a.k.a Bitcoin) when they are starving?

Here is some evidence I have been collecting in no particular order to support what I think is happening:

Prices increases this year

gas: +44%

airline tickets: +33%

used cars: +23%

hotels: +23%

bacon: +18%

oranges: +17%

tires: +16%

furniture: +15%

milk: +15%

coffee: +14%

deliveries: +14%

bread: +14%

baby food: +13%

soup: +13%

cereal: +12%

eggs: +10%

dry cleaning: +10%

(source)

"The food at home price index rose 10.8% over the last 12 months, the largest 12-month increase since the period ending November 1980." (source)

Even if we don't care about anything else, everyone needs food.

There are nations like Sri Lanka where people are rioting and already starving.

Then the production of all sorts of necessities has hit a huge standstill here in the United States:

"Ford stops taking orders on its popular F-150 truck for the rest of the year due to supply shortage."

I think Ford produces around 900k F-150s a year, and we are only May.

Multiple nations are proposing fixing the price of gasoline because it is about to skyrocket, Spain has already done it and the United States is considering it.

But even if they fix the price, that does not mean we will not run out soon.

The East Coast of the United States, where I live, is already feeling it.

"East coast diesel inventory has hit the lowest in history - data is only available since 1990"

There are reports that delivery trucks may soon not run.

Many nations have grounded their airlines due to the price of fuel and not being able to procure it.

"All Nigerian airlines say they will stop flying their domestic routes indefinitely after spike in jet-fuel prices" (source)

Then there is the home price to Median Income ratio, which has skyrocketed (due to inflation, of course)

Many companies are starting to realize what's about to happen; some already feel it and have started to lay people off.

We had a massive sell-off in tech earlier in the year, and this week, we had a massive sell-off in crypto, and Taleb thinks there will be much more

Then, of course, there is the fact that we just came out of a pandemic where supply chains and global production had already taken a massive hit due to lockdowns. And not to mention the amount of human life we lost from the virus.

It would be bad if a few of these things were happening at once. But all of them together like this seems like a recipe for disaster.

Of course, this is all my opinion, and I could be dead wrong. But I'd rather protect my family from the downsides of all of this as much as possible and I would gladly like to be wrong in this case.

So what does this mean for all of us?

I think we need to find ways to survive in the short term. Then in the medium to long term, if the world is going to overcome a collapse of globalization, it will only do so and regain efficiency from tech. Tech has been the great deflator, reducing prices in many segments of the economy by bringing in efficiency over the years since WWII.

I think companies with great fundamentals will weather all of this and will remain good investments. I also think any asset impacted by inflation (e.g. real-estate) will do well long term.

There are also some timeless things I learned about coming up from poverty; I learned to focus on the things that are valuable no matter what. The hard skills. That means building up skills and assets that we can reuse as much as possible.

Invest in yourself; then, no matter what happens, you can be prepared.

And we should also prioritize the things that make us happy and fulfilled like friends and family. Money will come and go, with good friends and family we can always make more, even in hard times.

I'd love to hear from you, especially if you think I am dead wrong about all of this. You can always reply to this email.

The Best Three Tweets I ran into this week:

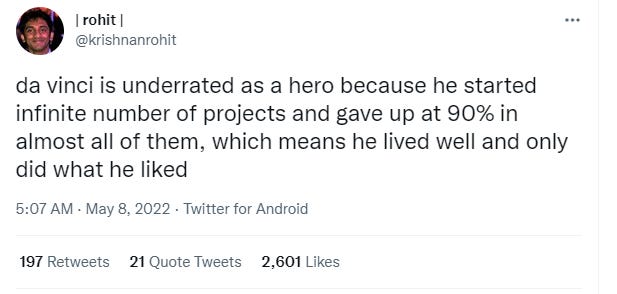

That's a good life worth living, chasing the things that inspire us and dumping the things that drain us. It's no wonder Da Vinci had so much success.

A good reminder by Sahil that no matter what happens, and no matter what the macro environment looks like, companies that can get customers will always thrive.

A good reminder that no matter what happens with the money, having good friends and family around you means you have the most important things in life. And when you have those you'll always be able to go out and make more.

Two Memes I Loved This Week:

I am a big fan of real-estate, have been for a long time, but this house is something else.

This is good for a number of reasons, but the main reason I love this meme is because my toddler does this all the time.

Some quick updates from me:

The eight episode of The Engineering Advice You Didn't Ask For podcast is out.

This one is all about cracking the interview, tips and tricks to get into FAANG and Big Tech.

Coincidentally my friend Zain from the Small Bets community launched a course on this very topic, titled Insider Advice on How you can pass FAANG Interviews. I bought the course and there are some great nuggets of wisdom especially toward the middle that I highly recommend. Interview advice is plentiful these days but hearing from someone that has gotten into Microsoft, Stripe, and recently Facebook is refreshing. Zain isn't paying me and that's not an affiliate link.

I recently gave some advice that I decided to share on a Twitter Thread to a friend that was looking to buy a two-family home recently.

There are some good nuggets of info on there about how I think we should think of pricing homes in this high interest environment.

We also finished our first week of The Newsletter Launchpad, we had 10 folks join (many are strangers that I am now getting to know) to learn how to start and succeed with newsletters.

Teaching the stuff I learned over the last year to a live group of people with my friend Chris Wong has been way more fun than I realized.

Thank you for reading. I hope you have a wonderful weekend.

Louie

P.S. you can respond directly to this email and I will do my best to reply. I'd love to hear from you.