M&Ms 60: Real Estate

You may recall that I told you we were in for some hard times a month back.

Then the hard times came. We aren't done yet.

Now the hard times are coming for real estate. Earlier this week, I gave my second talk to the Small Bets community, teaching them how to become small-time landlords.

Since then, there have been a lot of developments in this space.

The biggest development is that interest rates have climbed to over 6% on 30-year mortgages. That nearly doubles the monthly payment someone would pay on a new home purchase compared to what they would've paid at the beginning of this year on a 3% mortgage. Another interesting development was that Mortgage Backed Securities went with no bids earlier this week. If you are a Real Estate geek like me, you can read about it but the mortgage increases are far more important for tonight's newsletter.

And a lot of people are upset.

There are a lot of tweets like the one below of people comparing the payment on a home and how much one could afford at these new rates.

But few are showing you what you'd be able to afford if rates hit 11 or 12%. So here is my answer:

Many, including myself, believe they will have to go that high to curb inflation.

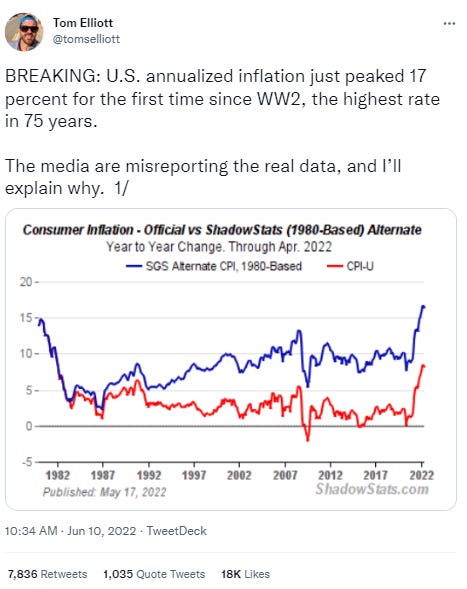

Inflation used to be defined simply as an expansion of the money supply. The government conveniently changed that definition a few decades back.

But the fact remains that 40% more money was printed in the last two years; reason and logic say that prices ought to keep going up unless the money supply is restricted with higher interest rates.

And it's never that simple because we have other problems too. Oil and food shortages globally due to the war in Ukraine put even more pressure on prices. And there are other problems beyond that globally which I covered last time.

But this is about inflation and inflation is bad.

Inflation robs people of their livelihoods. And runaway inflation, historically, causes people to take to the streets. See Germany post-world-war-I and right before world war II. The federal reserve is very unlikely to let runaway inflation take hold.

Inflation causes a lot of other bad things to happen, too, like stocks going down. Warren Buffet explained that inflation is like gravity on stocks; it hits them two ways. First, if risk-free interest rates, say in a checking account, pay you a few percent soon, companies will need to return more than that to justify your investment dollars. Then secondly, it makes borrowing money for companies in trouble a whole lot harder.

And Nicholas Taleb says that inflation causes unproductive asset classes such as crypto to melt, which is what we have been seeing.

And so, what does this mean for real estate and you and me?

The beauty of the American mortgage is that you can always refinance with no penalty. That means you can always refinance if you buy now at 6%, and somehow it magically drops back to 3%.

To me, this is very unlikely, and the more likely scenario is 10-12% 30-year mortgage rates. And if that does happen, you would be getting a good deal at a 6% fixed rate today.

Many assume that prices will come crashing down, but inventory impacts pricing significantly, and inventory is still at all-time lows. And materials and labor are not getting cheaper with inflation to produce more homes, so inventory is likely to remain low. And so you would need 50% price reductions on real estate to get a "good deal" by January standards. I believe prices will drop some, but 50% is improbable.

In this environment, anyone with a variable rate will get demolished. Luckily due to the historically low rates, there are very few adjustable-rate mortgages among the average household, but they are rampant in commercial real estate.

Nick Huber, a commercial real estate investor that invests in storage facilities, explained what this has meant for him in his newsletter this morning:

"I have $44 million of floating debt. Meaning the debt payment adjusts each month as key lending indicators change. My debt is floating at 30 bps over WSJP. Rates have risen 1.5% in the past 3 months. We are paying $660,000 more annually right now for our debt than we were 3 months ago. Ouch."

Nick spells out three likely scenarios going forward for real estate in his newsletter this morning. I won't bore you with all of them, but he puts a 30% chance on the doomsday scenario happening. The doomsday scenario is continued rising interest rates and the possibility of 10%+ mortgages.

I put the odds of that doomsday scenario at 70% likely.

Two Tweets I ran into this week that are related:

This is more or less my model for real estate investing and what I taught the small bets community.

I am fairly confident everyone will have to stay put soon.

Two Memes I ran into this week:

Thank you for reading. I hope you have a wonderful weekend.

Louie

P.S. you can respond directly to this email and I will do my best to reply. I'd love to hear from you.